nj bait tax example

Congress imposed the SALT cap on individuals as part of the tax reform law in 2017. New Jersey sourced income was 500000.

Therefore the BAIT may result in a significant overpayment 1 of non-resident tax until the owners can file their individual tax returns to claim refunds which could be as late as October of the following year.

. In New Jersey the PTE tax rates are progressive and based on the sum of each members share of distributive. Using the graduated tax schedule tax on 900000 would be 5656750. For example in 2018 and 2019 a taxpayer paying 15000 in property taxes on their New Jersey home and 20000 in state income tax would have been limited to an overall 10000 SALT deduction on their individual tax return.

The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business owners mitigate the negative impact of the federal state. Tax is imposed on the sum of each members share of distributive proceeds which is 900000. S corporation S has net income of 1000000 in 2020 and one individual shareholder A.

Lets say that you own a business that has 3 members with shares of distributive income sourced in New Jersey. The BAIT program is intended to give New Jersey individual income taxpayers a work-around of the 10000 annual limitation on the. The 2021 PTE-200-T Extension of Time to File grants a six-month extension to September 15 2022.

The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business owners mitigate the negative impact of the federal state and. ASC 740 Considerations for Pass-Through Entity Tax Regimes. Regardless of its participation in the BAIT a firm organized as a PTE must continue to withhold tax on the non-resident owners New Jersey income.

Each member can use the BAIT credit to offset their member-level tax liabilities. Since New Jerseys enactment of the Pass-Through Business Alternative Income Tax BAIT professional service firms and other pass-through entities have begun to reap the federal income tax benefits of this entity-level tax. Rather in that state an electing PTE can instead elect to be treated as a C corporation solely for Wisconsin income tax purposes and thus be subject to a flat 79 entity-level tax 13 14.

On January 13 2020 Governor Phil Murphy signed into law Senate Bill 3246 S. This new law allows pass-through businesses to pay income taxes at the entity level instead of the personal level. 3246 or bill establishing the business alternative income tax BAIT an elective New Jersey business tax regime for pass-through entities PTEs.

The BAIT is intended to give NJ individual income taxpayers a work-around of the 10000 annual limitation on the deductibility of state taxes at the federal level. The owners then receive a proportionate credit on their New Jersey gross income tax liability. For the 2020 tax year the four tiers of income tax rates are as follows.

Single member limited liability companies and sole proprietorships may not elect to pay the Pass-Through Business Alternative Income Tax. A BAIT Tax Example Calculation As mentioned above the NJ BAIT calculation will be made based on the sum of all the member shares of distributive proceeds. We will now walk through an example to help understand the calculation of tax due.

The New Jersey pass-through entity tax took effect Jan. Sole proprietors Schedule Cs and single member LLCs are not. For New Jersey tax purposes income and losses of a pass-through entity are passed through to its members.

Pass-through entity AB has 2 New Jersey resident members with total income of 1500000 that is 100 sourced to New Jersey. NJ Business Alternative Income Tax BAIT By Michael Brown CPA. The owner may then claim a refundable tax credit on their return for the amount of.

Each New Jersey resident members share of the entity level tax equals 565675050 2828375. However pass-through entities may elect to pay a Pass-Through Business Alternative Income Tax due on the sum of. This new law allows pass-through businesses to pay income taxes at the entity level instead of the personal level.

Wisconsin did not enact a brand-new tax. This date is not extended. To elect the BAIT each member of a PTE must consent to an annual election due on or before the original due date without.

54A1-1 et seq in a taxable year. Tax is imposed on the sum of each members share of distributive proceeds which is 1500000. Mechanics of the BAIT Election By passing through a net amount of income reduced by the SALT deduction the owner is able to fully deduct their New Jersey taxes for federal purposes.

Nj bait tax example Monday May 16 2022 The PTEs distributive income is subject to tax at the following graduated rates for purposes of computing the BAIT. BAIT filers should be aware that the NJ Division of Taxation made certain key changes that affect 2021 BAIT reporting. 42788750 plus 109 for distributive proceeds over 5000000.

When Governor Murphy signed the Pass-Through Business Alternative Income Tax BAIT into law it allowed pass-through entities to elect to pay tax on behalf of the owners share of distributive proceeds. 1418750 plus 652 for distributive proceeds between 250000 and 1000000. An increasing number of states are embracing an entity-level income tax on pass-through entities PTEs as a way to mitigate the 10000 deduction limit for state and local income taxes SALT cap.

The New Jersey pass-through entity tax took effect Jan. The entity must have at least one member who is liable for tax on their share of distributive proceeds pursuant to the New Jersey Gross Income Tax Act NJSA. The distributive proceeds sourced to New Jersey are allocated 750000 to Member A and 750000 to Member B.

Consider the following simplified example.

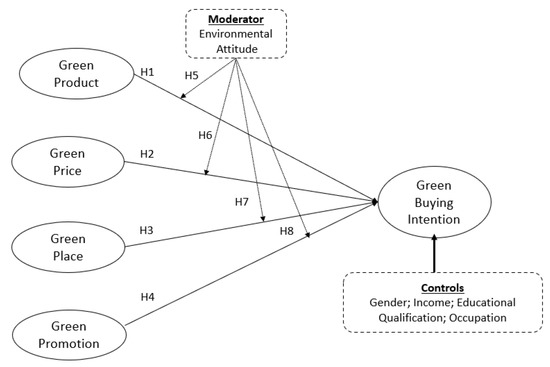

Sustainability Free Full Text Green Marketing Strategies Environmental Attitude And Green Buying Intention A Multi Group Analysis In An Emerging Economy Context Html

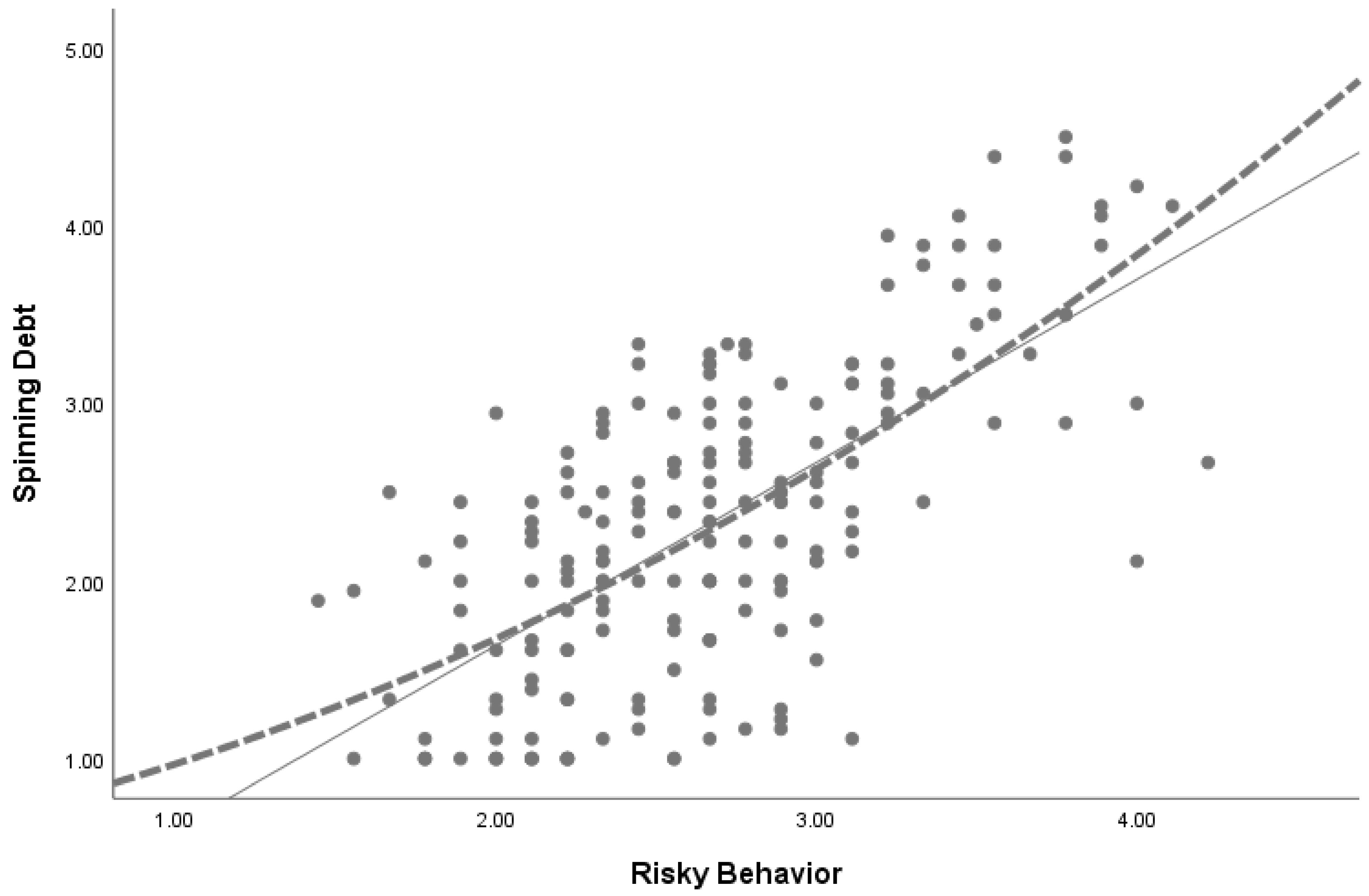

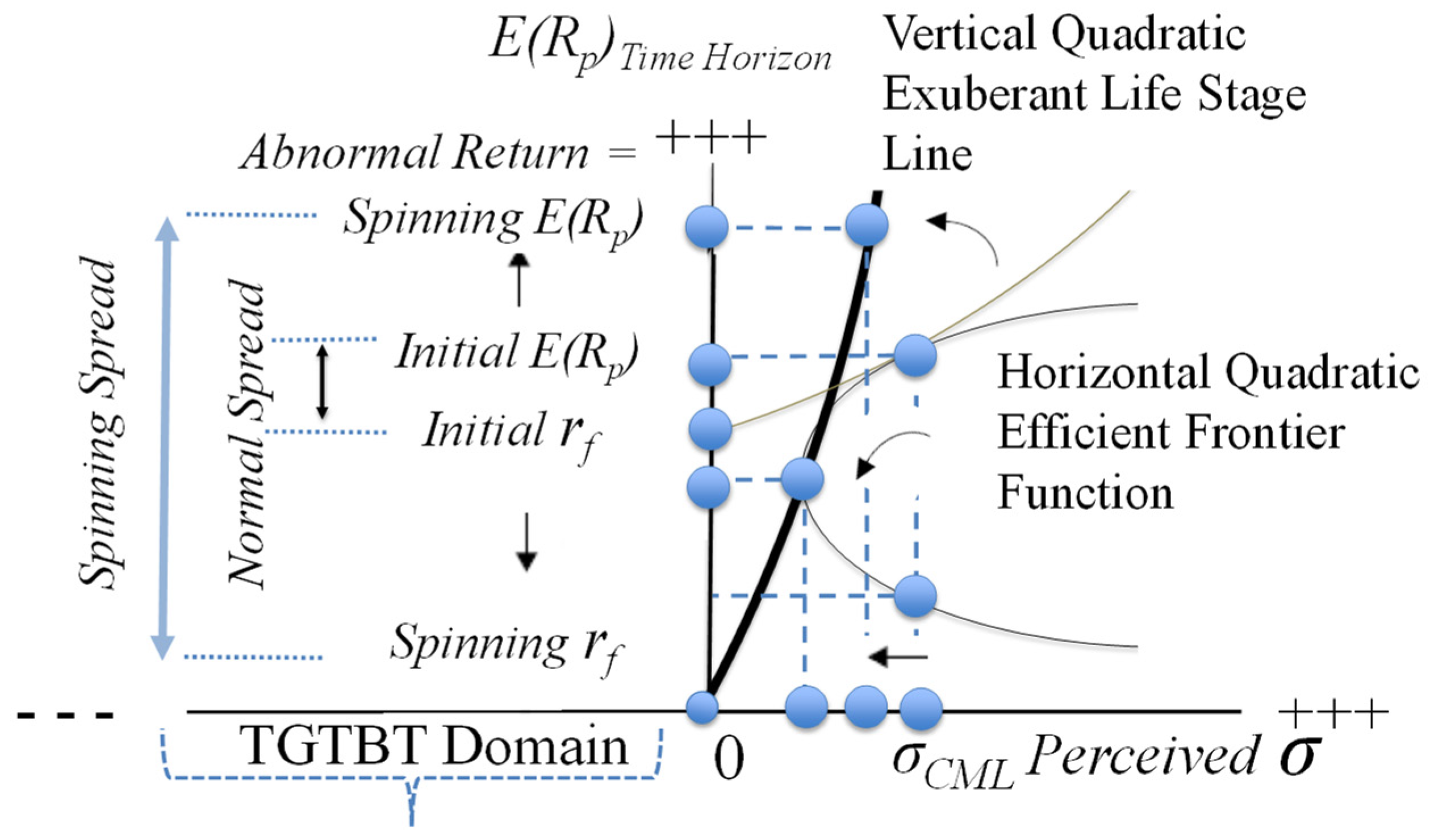

Ijfs Free Full Text Buy Now And Pay Dearly Later Unraveling Consumer Financial Spinning Html

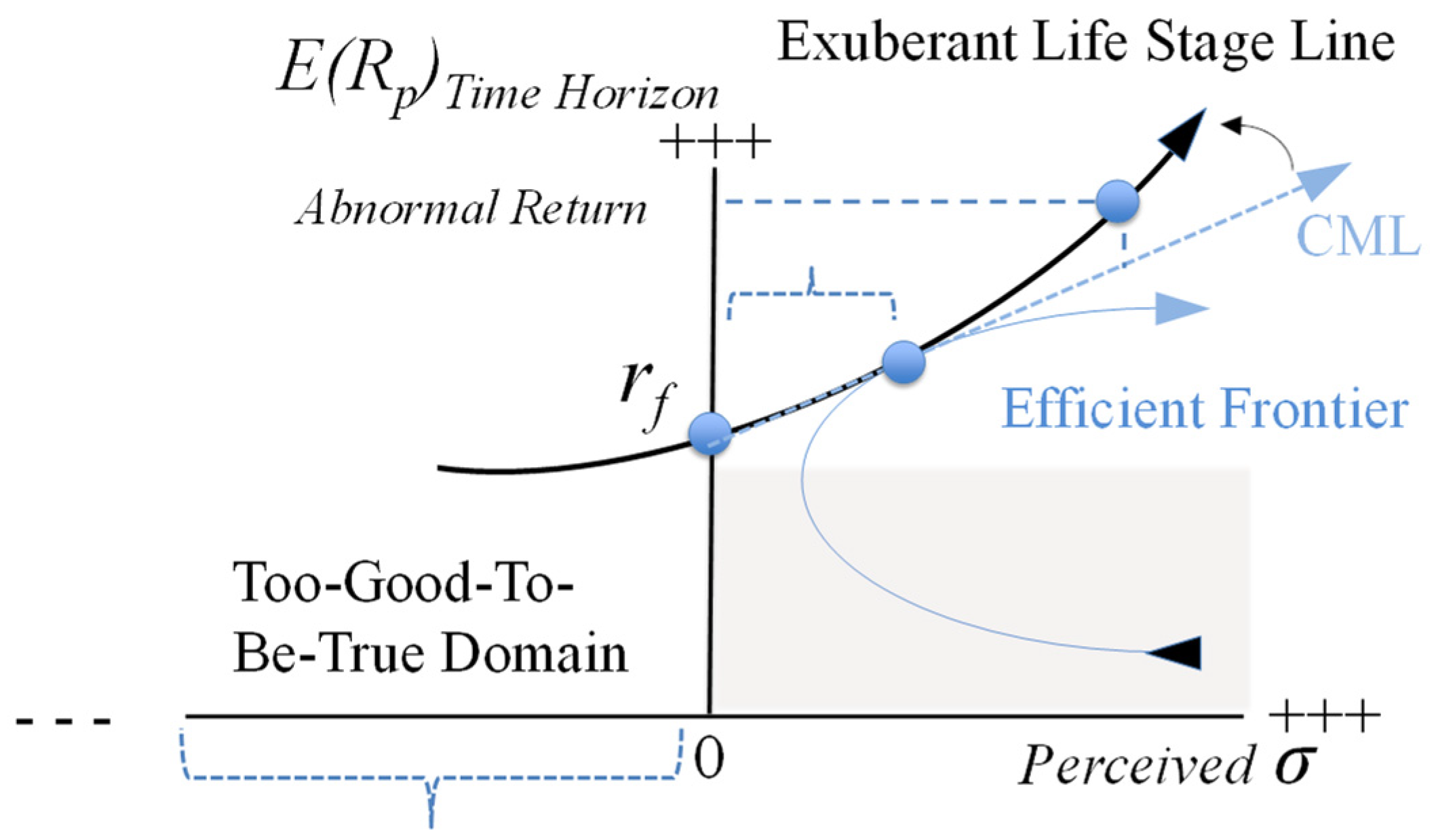

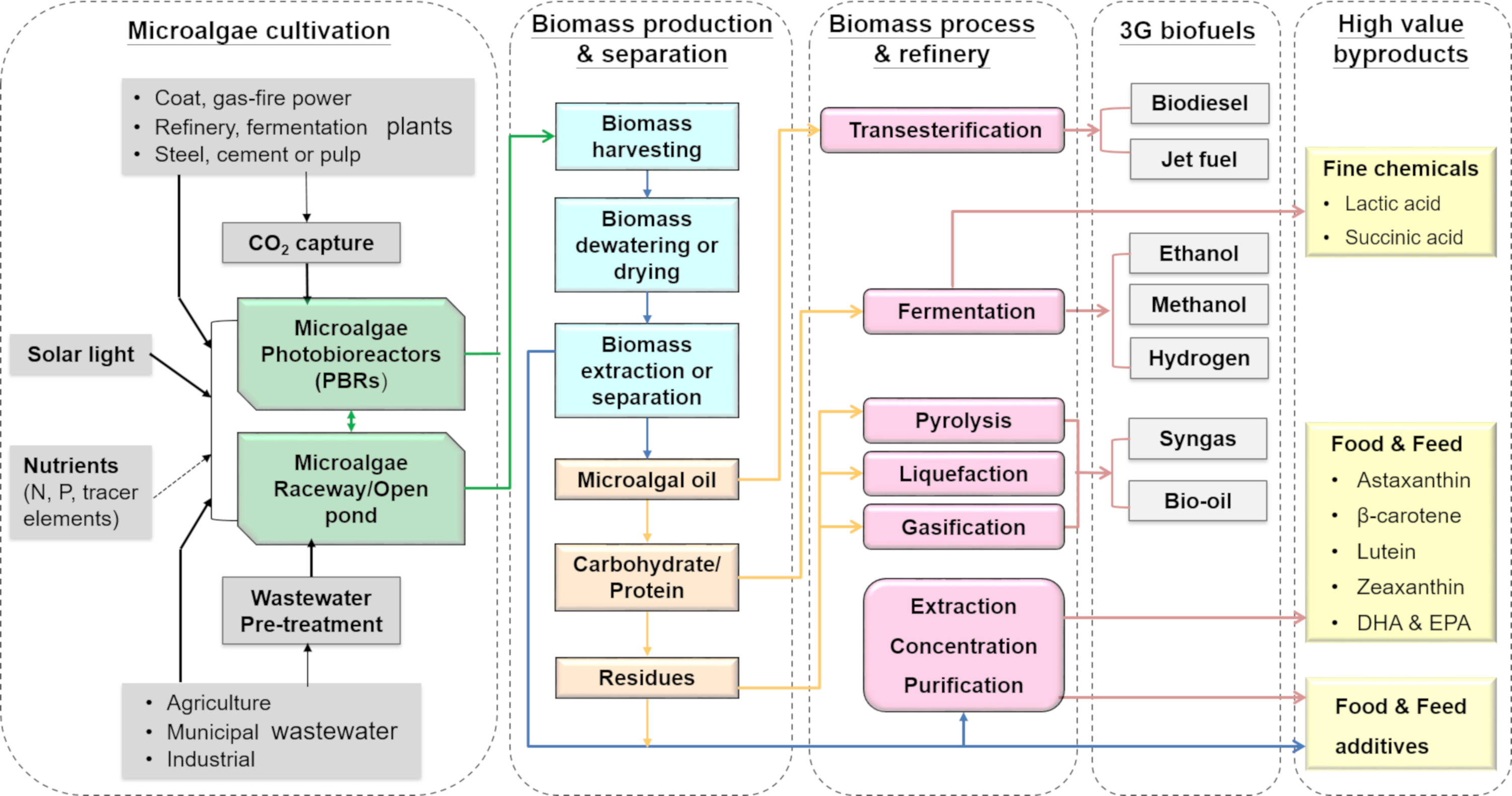

Sustainability Free Full Text Cultivation And Biorefinery Of Microalgae Chlorella Sp For Producing Biofuels And Other Byproducts A Review Html

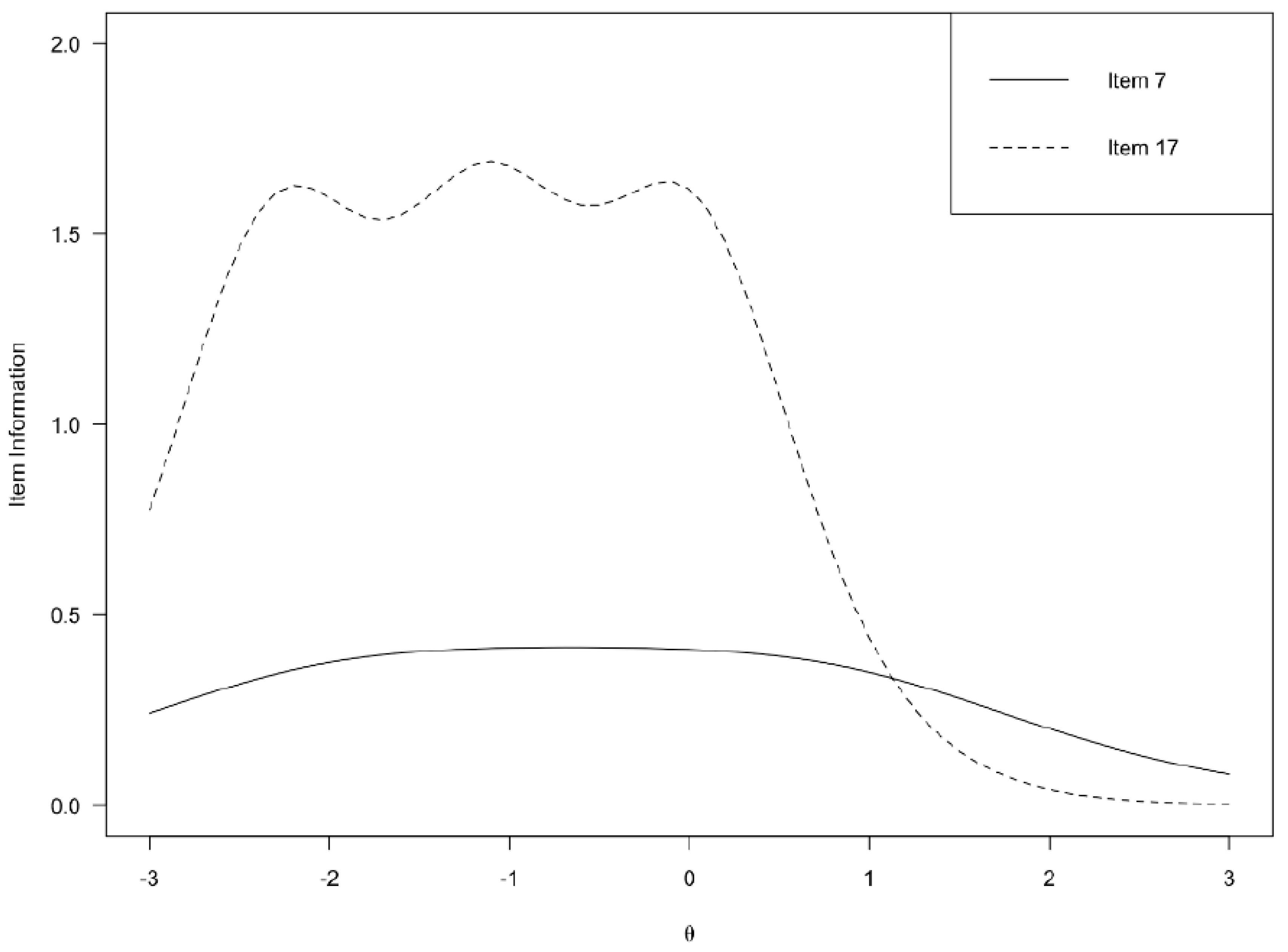

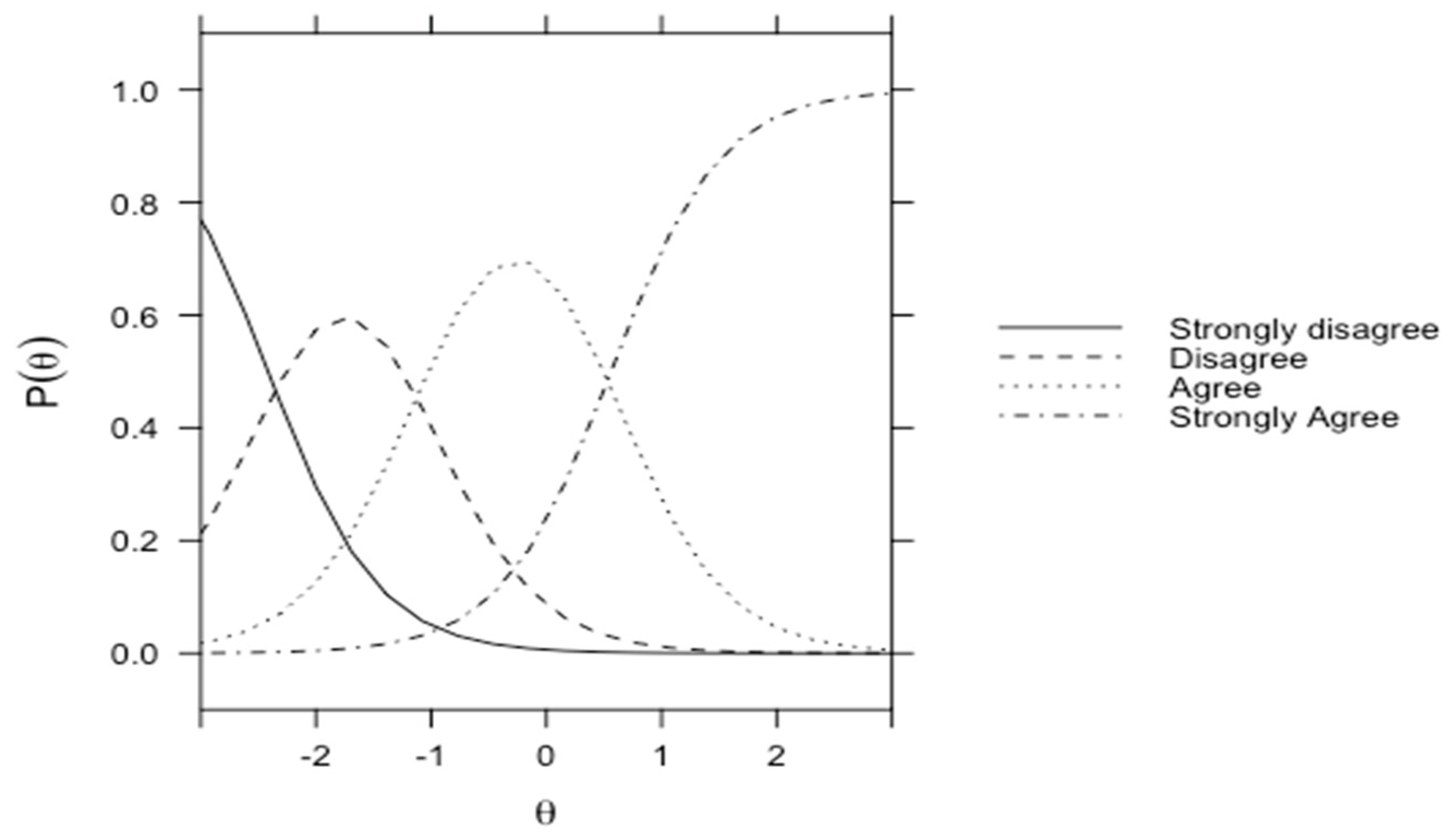

Ijfs Free Full Text Buy Now And Pay Dearly Later Unraveling Consumer Financial Spinning Html

Sustainability Free Full Text Cultivation And Biorefinery Of Microalgae Chlorella Sp For Producing Biofuels And Other Byproducts A Review Html

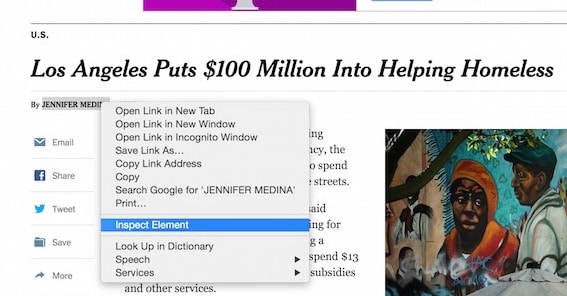

How To Use Google Sheets As A Basic Web Scraper

Sustainability Free Full Text Measuring Perceived Corporate Hypocrisy Scale Development In The Context Of U S Retail Employees Html

How To Use Google Sheets As A Basic Web Scraper

Ijfs Free Full Text Buy Now And Pay Dearly Later Unraveling Consumer Financial Spinning Html

How To Use Google Sheets As A Basic Web Scraper

Boating Marine Lakes On The App Store

Dental Insurance 101 In 2022 Dental Insurance Plans Dental Insurance Dental Coverage

Is Your Landlord Harassing You Property Manager Examples How To Report

Llc Annual Report Template 1 Templates Example Templates Example Report Template Annual Report Small Business Plan Template

Sustainability Free Full Text Measuring Perceived Corporate Hypocrisy Scale Development In The Context Of U S Retail Employees Html

50 Best Teacher Resignation Letters Ms Word ᐅ Templatelab Teacher Resignation Letter Resignation Letters Resignation Letter Sample