california renters credit turbotax

For instance people with credit report listed below 640 are generally considered to be subprime borrowers. Can Housemates claim the Nonrefundable Renters Credit when Im the one who pays the rent to the landlord.

Turbotax Lets You File Taxes For Free But There S A Catch Money

Each state has its own regulations around a renters tax credit.

. I have two housemates who claimed this when Im the one who is on the lease and pays the rent to the landlord. Current state law allows a nonrefundable credit for qualified renters in the following amounts for tax year 2017. California This credit is similar to the federal Earned Income Credit EIC but with different income limitations.

California also has an earned income tax credit. I am confused on what principal residence means. These states have worked out their own formulas for awarding a renters tax credit to eligible tenants.

Yes California has a renters credit. Have a family with children or help provide money for low-income college students. Use one of the following forms when filing.

I lived on a off-campus apartment and my name is on a lease so I do pay rent. It plays a essential role in a loan providers choice to state yes or no to your loan or credit card application. For example if you live in California you may qualify for a renters credit if you pay rent for your housing your income is below a certain amount and you meet other state requirements.

If you are Married Filing Joint the credit is 120. Widower How to claim. 43533 or less if filing status is single or marriedRDP filing separately.

However for whatever reason when I try to claim it it says that I am not eligible even though my. Can you claim California Renters Credit for rent paid to parents that are claiming homeownership. The other eligibility requirements are as follows.

Ad Finish Filing Your Taxes w TurboTax And See How Easy It Can Be. California Renters Credit According to the California Tax Boards requirements I qualify for the Renters Credit. I am a college student filing independent.

Several states also provide tax relief for renters who dont meet age or disability criteria. Posted by 1 year ago. 60 credit if you are.

A credit score is a significant aspect of your financial life. File Your Taxes Today. However I was not on the lease in the apartment I rented my two roommates were and had an extra room I rented.

In the California interview look for the section called Renters Credit. You paid rent for a minimum of six months for your principal residence. TurboTax will ask you the qualifying questions determine if you qualify and calculate the credit for you.

To qualify for the CA renters credit. If you pay rent for your housing. Federal law lacks a credit comparable to the states Renters Credit.

You can still qualify for the credit even. To claim the California renters credit your income must be less than 40078 if youre single or 80156 if youre filing jointly. 60 for single or married filing separately with an adjusted gross income AGI of 40078 or less and.

Tax credits help reduce the amount of tax you may owe. For Single filer it is 60. A simple tax return.

You may be eligible for one or more tax credits. Neither you nor your spouse if married was granted a homeowners property tax exemption during 2021. The refundable California Earned Income Tax Credit EITC is available to taxpayers who earned wage income in.

Renters in California may qualify for up to 120 in tax credits. Exempt property includes most government-owned buildings church-owned parsonages college dormitories and military barracks. Renters Credit on TurboTax Did you pay rent for at least half of 2019 on property in California that was your principal residence is what they asked.

You rented property for more than half the year that was not exempt from California property tax in 2021. Clients California adjusted gross income AGI was. In California renters who pay rent for at least half the year and make less than a certain amount currently 43533 for single filers and 87066 for married filers may be eligible for a tax credit of 60 or 120 respectively.

87066 or less if marriedRDP filing jointly head of household or qualified widower. California Renters Credit SOLVED by Intuit Lacerte Tax 8 Updated August 20 2021 Use Screen 53013 California Other Credits to enter information for the Renters credit. You must be a California resident for the tax year youre claiming the renters credit.

EITC reduces your California tax obligation or allows a refund if no California tax is due. 120 credit if your are. File your income tax return.

Can you claim California Renters Credit for rent paid to parents that are claiming homeownership. California Resident Income Tax Return Form 540 line 46. Client paid rent in California for at least half the year.

Under the Provincial tab select Provincial Tax Credits Profile then make sure to check the boxes Education Property Tax Credit rent paid and the next box Manitoba School Tax Credit proceed to the next screen which allows for input of your housing information. The property rented wasnt exempt from California property. 0 Federal 0 State 0 To File offer is available for simple tax returns only with TurboTax Free Edition.

The 2019 earnings limits are 42932 single and 85864 married. Snap A Photo Of Your W-2 And Jumpstart Your Taxes With TurboTax.

Best Tax Software Of 2022 Forbes Advisor

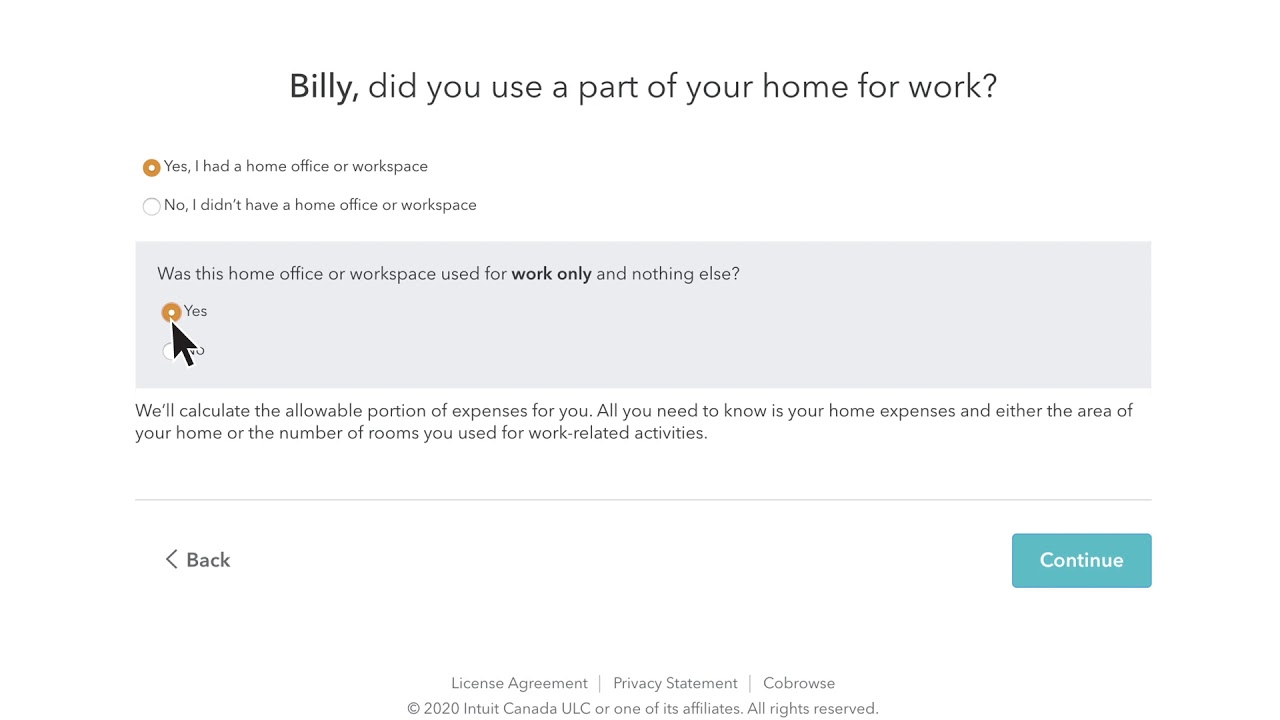

Can I Deduct Work At Home Expenses 2022 Turbotax Canada Tips

Turbotax Review 2022 Pros And Cons

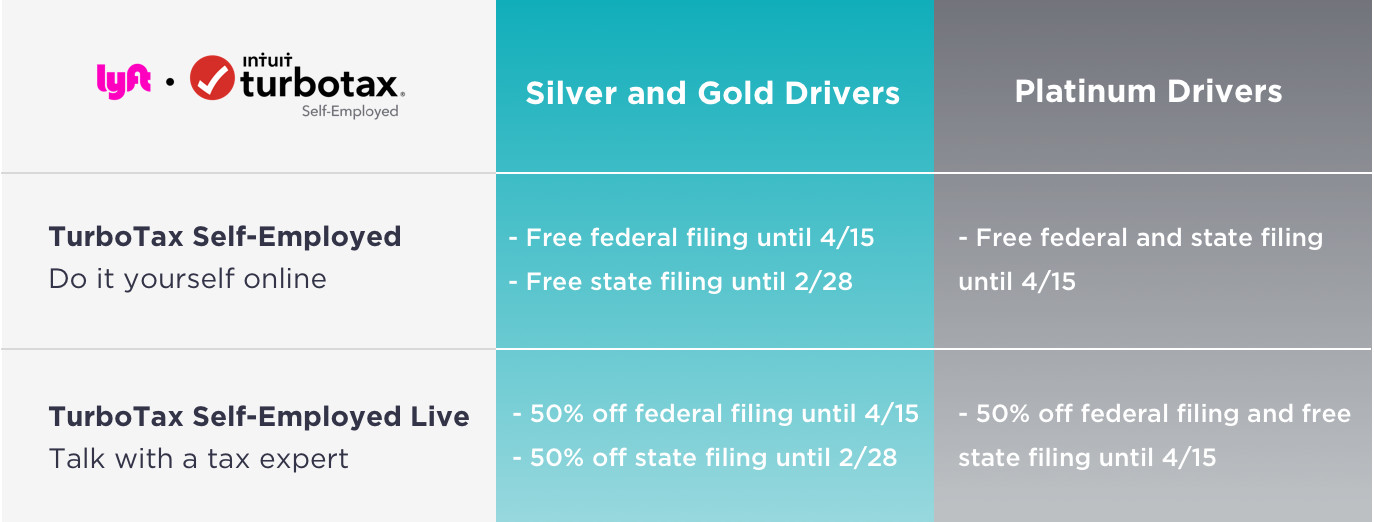

Get Ready For The 2019 Tax Season The Hub

2020 S Top Home Trends And Features To Start The Decade Off Right Home Trends Types Of Houses Solar Water Heating

Turbotax Vs H R Block Which Online Tax Service Is Best

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Turbotax Review 2022 Online Tax Filing Software U S News

How To File Taxes For Free Turbotax 2022 Free File Change Money

Home Office Deductions For Self Employed And Employed Taxpayers 2022 Turbotax Canada Tips

Can Landlords Use Turbotax For Their Rental Properties

Turbotax Refund Advance Loan Review Credit Karma

How To Rent Out Your House Or Vacation Property Renting Out Your House Vacation Property Vacation Rental Management

Did Anyone Actually Get The Turbotax Affiliate Link Discount R Personalfinance

Turbotax Irs Launch Online Portal For Stimulus Check Direct Deposit

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Best Tax Software Of 2022 Forbes Advisor

10 Tax Tips For Airbnb Homeaway Amp Vrbo Vacation Rentals Turbotax Tax Tips Amp Videos Vacation Rental Homeaway Rental

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips